Introduction

Definition of drone services

Drone services, in the context of insurance claims, refer to the utilization of unmanned aerial vehicles (UAVs) for the assessment, documentation, and analysis of damages. These services have gained significant importance in the insurance industry due to their ability to provide quick and accurate data collection, especially in hard-to-reach or hazardous areas. By deploying drones, insurance companies can efficiently inspect and evaluate property damage, assess liability, and streamline the claims process. The use of drone services has not only improved the efficiency and accuracy of insurance claim investigations but has also reduced costs and turnaround times, benefiting both insurers and policyholders.

Overview of insurance claims process

Insurance claims process refers to the step-by-step procedure that policyholders follow when they experience an insured event and need to seek compensation from their insurance company. It typically involves several stages, starting with the initial notification of the claim and followed by the investigation, assessment of damages, and final settlement. The advent of drone services has revolutionized this process by providing insurers with a faster, more accurate, and cost-effective way to assess and document claims. Drones equipped with high-resolution cameras and advanced software can capture detailed images and videos of damaged properties, allowing insurance adjusters to remotely inspect and evaluate the extent of the loss. This technology enables faster claims processing, reduces the need for physical inspections, and minimizes the possibility of human error. With the growing role of drone services in insurance claims, policyholders can expect a more streamlined and efficient claims experience, leading to quicker resolutions and enhanced customer satisfaction.

Importance of efficient claims handling

Efficient claims handling is of utmost importance in the insurance industry, and the growing role of drone services has proven to be a game-changer. With the ability to quickly and accurately assess damage, drone services offer insurance companies a more efficient way to process claims. Drones can capture high-resolution images and videos, providing insurers with valuable evidence to support their decision-making process. By leveraging drone technology, insurance companies can streamline their claims handling procedures, minimizing delays and improving customer satisfaction. Furthermore, the use of drones can also enhance safety and reduce risks for adjusters, as it eliminates the need for manual inspections in hazardous or hard-to-reach areas. As the demand for fast and reliable claims processing continues to rise, the integration of drone services in insurance claims is becoming increasingly imperative.

Benefits of Drone Services in Insurance Claims

Improved accuracy in assessing damages

Improved accuracy in assessing damages is one of the major advantages that drone services offer in the insurance claims process. Traditional methods of assessing damages often involve human inspection, which can be time-consuming and prone to errors. With the use of drones, insurance companies can now acquire detailed aerial images and footage of the damaged property, allowing them to get a more accurate and comprehensive understanding of the extent of the damage. This not only speeds up the claims process but also ensures fair compensation for policyholders. Additionally, the data collected by drones can be analyzed using advanced software, enabling insurance adjusters to identify and quantify specific damages, such as roof or structural damage, with greater precision. Overall, the implementation of drone services in insurance claims brings about improved accuracy and efficiency, benefiting both insurers and policyholders.

Faster claims processing

In today’s fast-paced world, speed is key, especially when it comes to insurance claims processing. With the growing role of drone services, insurance companies are now able to process claims faster than ever before. By utilizing drones, adjusters can quickly assess the damage and gather crucial data to determine the extent of the loss. This not only expedites the claims process but also reduces the need for manual inspections, saving time and resources. As a result, policyholders can receive their payouts more efficiently, providing them with the financial support they need during difficult times. The adoption of drone services in insurance claims has revolutionized the industry, making it more streamlined and customer-centric.

Enhanced safety for claims adjusters

Drone services are playing an increasingly important role in the insurance industry, particularly when it comes to claims adjusting. One area where drones have enhanced safety for claims adjusters is during property inspections. Traditionally, claims adjusters had to physically assess damaged areas, which could be risky and time-consuming. With the use of drones, however, adjusters can now remotely inspect rooftops, buildings, and other hard-to-reach areas, reducing the risk of injury and expediting the claims process. Additionally, drones equipped with thermal imaging cameras can identify hidden damages that are not visible to the naked eye, providing a more accurate assessment of the loss. Overall, the integration of drone services has revolutionized the claims adjusting process, helping to improve safety, efficiency, and accuracy in the insurance industry.

Use Cases of Drone Services in Insurance Claims

Property damage assessment

In the field of property damage assessment, drone services have emerged as a valuable tool for insurance claims. These unmanned aerial vehicles enable insurers to quickly and accurately assess the extent of damage to properties in a cost-effective manner. Drones equipped with high-resolution cameras and sensors can capture detailed images and data, providing a comprehensive view of the affected area. This technology allows insurance companies to streamline the claims process, reducing the time and resources required for on-site inspections. Additionally, drone services can assist in identifying potential hazards and assessing risk factors, aiding in the underwriting process. With the growing adoption of drone services, insurance companies are benefiting from improved efficiency, increased accuracy, and enhanced customer satisfaction in property damage assessment.

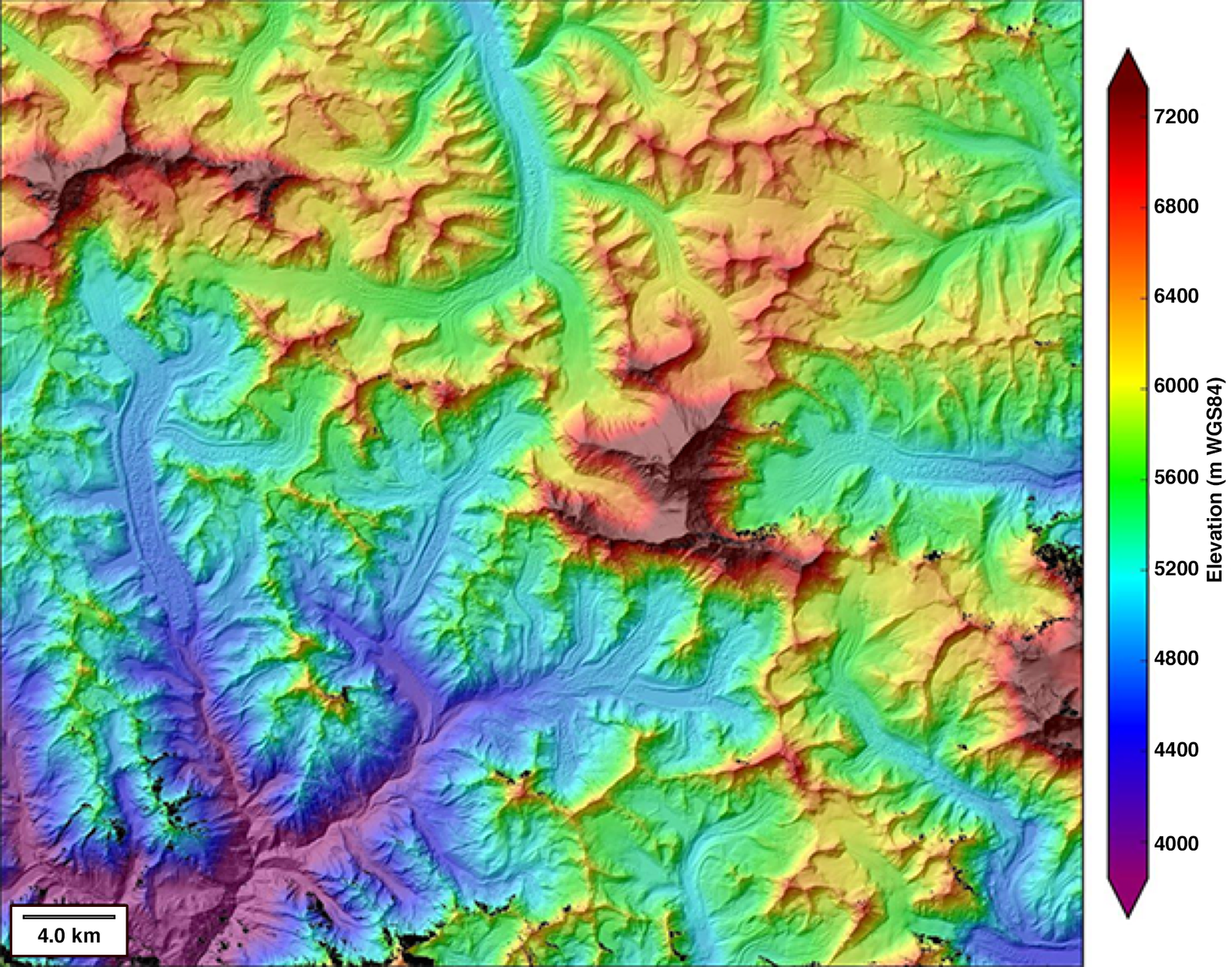

Natural disaster response

Natural disasters pose significant challenges to insurance companies in assessing and processing claims. However, with the growing role of drone services, the insurance industry is finding innovative ways to improve their response to these situations. Drones equipped with high-resolution cameras and advanced imaging software allow insurers to quickly and accurately survey the affected areas, capturing detailed data and images that can be used in the claims process. This not only expedites the claim settlement but also reduces the risk of human error in assessment. Additionally, drones can access difficult-to-reach areas, providing insurers with a comprehensive view of the damage and enabling them to make more informed decisions. As the use of drone services continues to grow, insurance companies are benefiting from increased efficiency and improved customer satisfaction in the aftermath of natural disasters.

Risk assessment and underwriting

Risk assessment and underwriting play a crucial role in the insurance industry, as they help insurers evaluate and manage the risks associated with various policies. With the growing role of drone services, insurers are now able to gather more accurate and detailed data for risk assessment. Drones can capture high-resolution images and videos of properties, allowing insurers to assess potential risks more effectively. Additionally, drones can be used to inspect hard-to-reach areas, such as rooftops or tall buildings, which may be risky for human inspectors. By leveraging drone services, insurance companies can make more informed decisions during the underwriting process, leading to better coverage options and pricing for policyholders.

Challenges and Limitations of Drone Services in Insurance Claims

Regulatory restrictions

Regulatory restrictions have become a significant factor in the utilization of drone services in insurance claims. As the use of drones continues to grow in the insurance industry, government agencies have established rules and regulations to ensure safety and privacy. These regulations vary from country to country and include restrictions on flight altitude, airspace limitations, and obtaining permits for commercial drone operations. Insurance companies need to navigate through these regulatory requirements to effectively incorporate drone services into their claims process while adhering to legal and ethical standards. The evolving regulatory landscape presents both challenges and opportunities for insurers looking to leverage the benefits of drone technology in improving claim assessments and accelerating the claims settlement process.

Privacy concerns

Privacy concerns surrounding the use of drone services in insurance claims have been on the rise. As these unmanned aerial vehicles continue to play a growing role in assessing damages and gathering data for insurance purposes, questions regarding the potential invasion of privacy have emerged. The ability of drones to capture high-resolution images and videos from above raises concerns about individuals’ security and confidentiality. Additionally, there is uncertainty about the collection, storage, and use of personal information obtained by drones. It is crucial for insurance companies and regulatory bodies to address these concerns and establish comprehensive guidelines to ensure the privacy and data protection of policyholders and other parties involved.

Technical limitations

Drone services have become increasingly valuable in the insurance industry, particularly in handling claims. However, like any technology, drones have their own set of technical limitations. One common limitation is battery life, which restricts the amount of time a drone can spend in the air. Another limitation is the range of the drone, as they are typically limited to a certain distance from the operator. Additionally, weather conditions such as strong winds or heavy rain can affect a drone’s ability to operate effectively. Despite these limitations, insurance companies are finding innovative solutions to overcome these challenges and maximize the benefits of drone services in claims processing.

Future Trends in Drone Services for Insurance Claims

Integration of artificial intelligence

Artificial intelligence (AI) is revolutionizing the insurance industry, and its integration with drone services is playing a crucial role in improving claims processing. AI-powered algorithms can analyze large amounts of data collected by drones, such as images and videos of damaged properties, and accurately assess the extent and cost of the damage. This not only speeds up the claims settlement process but also reduces the risk of fraud by detecting any inconsistencies or discrepancies in the data. Additionally, AI can predict potential risks and help insurance companies offer more personalized policies based on individual customer preferences and behavior patterns. The integration of AI with drone services is transforming the insurance claims landscape, enabling faster, more efficient, and accurate claim assessments.

Advancements in drone technology

Advancements in drone technology have revolutionized the insurance claims process, particularly in the realm of property inspections. With the ability to capture high-resolution imagery and video footage from challenging angles and heights, drones have become invaluable tools for insurance companies. This technology allows adjusters to assess damage accurately and efficiently, saving both time and money. Additionally, drones can access hard-to-reach areas, such as rooftops and inaccessible terrain, ensuring comprehensive inspections. The use of drones in insurance claims not only enhances the speed and accuracy of assessments but also improves customer experience by minimizing disruptions and expediting the claims settlement process.

Collaboration with other emerging technologies

The collaboration between drone services and other emerging technologies is reshaping the insurance industry, particularly in the area of claims processing. Drones provide a valuable tool for capturing detailed aerial imagery of accident scenes and property damage, allowing insurers to quickly assess the extent of loss and make informed decisions. Additionally, by integrating drone data with advancements in artificial intelligence and machine learning, insurers can automate and streamline the claims process, reducing paperwork and improving accuracy. This collaboration not only improves efficiency but also enhances customer experience, as policyholders can receive faster and more accurate claims settlements. As technology continues to evolve, the collaboration between drone services and other emerging technologies will play an increasingly important role in the insurance industry’s efforts to better serve its customers and adapt to changing trends and challenges.

Conclusion

Summary of benefits and challenges

The growing role of drone services in insurance claims brings both benefits and challenges. On the one hand, the use of drones allows for more accurate and efficient assessment of damages, especially in areas that are difficult to access. Drones can quickly and safely survey large areas and provide high-resolution imagery, helping insurance companies assess claims faster and more accurately. Additionally, drones can help improve safety during the claims process by reducing the need for physical inspections in potentially hazardous locations. On the other hand, the integration of drones in insurance claims also presents challenges. This includes the need for proper training and certification of drone operators, ensuring compliance with privacy regulations, and addressing potential concerns related to data security and insurance fraud. Overall, the use of drones in insurance claims offers great potential to streamline the assessment process and improve the customer experience, but careful consideration of benefits and challenges is necessary for successful implementation.

Potential impact on insurance industry

The potential impact of drone services on the insurance industry is immense. With the ability to capture high-resolution images and video, drones can provide valuable data for insurance claims assessment. This technology allows insurance companies to conduct more accurate and efficient inspections of properties and assets, resulting in faster claim processing and reduced costs. Drones can also assist in disaster response and claims investigation, providing aerial views of affected areas and simplifying the claims management process. By leveraging drone services, insurance companies can improve their overall efficiency, streamline their operations, and provide better services to policyholders.

Call to action for insurers to embrace drone services

In order to stay competitive in the insurance industry, it is crucial for insurers to embrace and harness the power of drone services. The use of drones can streamline the claims process and provide more accurate and efficient assessments of damages. Insurers can leverage the capabilities of drones to quickly gather aerial imagery, conduct inspections in hard-to-reach areas, and assess property damage more effectively. By adopting drone services, insurers can not only improve customer service by expediting the claims process but also reduce costs associated with manual inspections and investigations. It is imperative for insurers to seize this opportunity to integrate drone technology into their operations and stay at the forefront of innovation in the industry.